欢迎访问我的个人主页!

Hello! Welcome to my personal home page.

个人简介

姓名:刘克(博士生导师)

所别:应用数学研究所

职称:研究员

房间号:南楼 609

邮箱:kliu@amss.ac.cn

学位:

理学学士(应用数学与运筹学):中国科学技术大学,1982年,中国

哲学博士(应用数学):南澳大利亚大学,1997年,澳大利亚

工作经历:

1982年9月至1985年9月:中国科学院应用数学研究所,研究实习员

1985年9月至1990年11月:中国科学院应用数学研究所,助理研究员

1990年11月至1997年9月:中国科学院应用数学研究所,副研究员

1997年9月至现在:中国科学院应用数学研究所,研究员

1998年4月至2007年5月:任中国科学院应用数学研究所运筹室主任

2007年3月至现在:中国科学院数学与系统科学研究院,研究员

其它经历:

1991年在美国Maryland大学数学系访问学者(6个月)

1997年在香港中文大学工业工程与工程管理系访问学者(2个月)

1997年在澳大利亚南澳大学数学系访问学者(1个月)

1998年在香港中文大学工业工程与工程管理系访问教授(2个月)

1999年在香港城市大学管理科学系访问研究员(2个月)

2000年在香港中文大学工业工程与工程管理系访问教授(2个月)

2000年在澳大利亚南澳大学数学系访问教授(2周)

2001年在香港科技大学信息与系统管理系访问教授(2个月)

2001到2005,多次在香港城市大学管理科学系访问研究员

社会兼职:

中国运筹学会会员、常务理事(2008-)、秘书长(2012-)

中国运筹学第三届青年工作委员会副主任委员(1997-1999)

中国运筹学第四届青年工作委员会副主任委员(1999-2001)

中国运筹学第五届青年工作委员会副主任委员(2001-2003)

中国运筹学会不确定系统分会副理事长(2003-2011)

中国运筹学第六届青年工作委员会委员(2003-2004)

中国运筹学会青年工作委员会法人代表(2003-2008)

中国运筹学会决策科学分会常务理事

北京运筹学会副理事长(2008-)

《运筹学学报》常务编委(2009-)

《运筹与管理》执行副主编(2009-)

获奖情况:

1988年获中国科学院科技进步2等奖(集体)

1993-1997获澳大利亚国家海外研究生奖学金

1995年获澳大利亚南澳大学学生研究奖

研究方向

-

- 马氏决策过程

- 马尔可夫决策过程(Markov Decision Processes,简记为MDP),是研究随机序贯决策问题的一门重要理论。被广泛应用于生产存储系统、系统更换/维修、制造系统的调度控制、计算机/通信网络系统控制、动态资产定价、广告优化、商品与服务的定价、质量控制、序贯搜索、水资源管理、森林管理、航空订票、高速公路管理等多个领域。

-

- 随机最优化

- 随机最优化指带有随机因素的最优化问题,利用概率统计、随机过程、随机分析等工具解决。

-

- 供应链管理

- 供应链管理,指在满足一定的客户服务水平的条件下,为了使整个供应链系统成本达到最小而把供应商、制造商、仓库、配送中心和渠道商等有效地组织在一起来进行的产品制造、转运、分销及销售的管理方法。供应链管理包括计划、采购、制造、配送、退货五大基本内容。

-

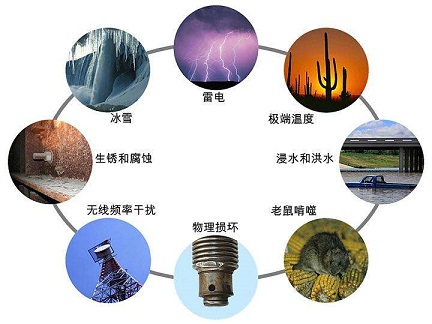

- 可靠性理论

- 可靠性理论是可靠性研究的最重要的基础理论之一,它主要是研究与解决各种可靠性问题的数学方法和数学模型,研究可靠性的定量规律。

学术论文

-

OPTIMAL ORDERING IN A DUAL-SUPPLIER SYSTEM WITH DEMAND FORECAST UPDATES

We study how an updated demand forecast affects a manufacturer's choice in ordering raw materials. With demand forecast updates, we develop a model where raw materials are ordered from two suppliers—one fast but expensive and the other cheap but slow—and further provide an explicit solution to the resulting dynamic optimization problem. Under some mild conditions, we demonstrate that the cost function is convex and twice-differentiable with respect to order quantity. With this model, we are able to evaluate the benefit of demand information updating which leads to the identification of directions for further improvement. We further demonstrate that the model applies to multiple-period problems provided that some demand regularity conditions are satisfied. Data collected from a manufacturer support the structure and conclusion of the model. Although the model is described in the context of in-bound logistics, it can be applied to production and out-bound logistics decisions as well.

-

Empty container management in a port with long-run average criterion

The empty container allocation problem in a port is related to one of the major logistics issues faced by distribution and transportation companies: the management of importing empty containers in anticipation of future shortage of empty containers or exporting empty containers in response to reduce the redundance of empty containers in this port. We considered the problem to be a nonstandard inventory problem with positive and negative demands at the same time under a general holding-penalty cost function and one-time period delay availability for full containers just arriving at the port. The main result is that there exists an optimal pair of critical policies for the discounted infinite-horizon problem via a finite-horizon problem, say (U, D). That is, importing empty containers up to U when the number of empty containers in the port is less than U, or exporting the empty containers down to D when the number of empty containers is more than D, doing nothing otherwise. Moreover, we obtain the similar result over the average infinite horizon.

-

A note on optimality conditions for continuous-time Markov decision processes with average cost criterion

This note deals with continuous-time Markov decision processes with a denumerable state space and the average cost criterion. The transition rates are allowed to be unbounded, and the action set is a Borel space. We give a new set of conditions under which the existence of optimal stationary policies is ensured by using the optimality inequality. Our results are illustrated with a controlled queueing model. Moreover, we use an example to show that our conditions do not imply the existence of a solution to the optimality equations in the previous literature.

-

Single period, single product newsvendor model with random supply shock

In order to investigate the efficiency of policies made by the industrial administration office (IAO for short) so as to keep market order, the authors propose a shocked inventory model of one product with both genuine and counterfeit qualities. The checking policies made by the IAO are considered to be a random shock for the inventory model by examination of the qualities of the products, which will expropriate the counterfeit products. The paper makes two contributions. First, while discussing several conditions, the authors provide a basic theory, which is a kind of extension of the newsvendor problem, and prove some properties of the optimal policies for the shocked inventory model with a fixed random checking rate. Second, the authors give some recommendations as to how the IAO can formulate its checking policies. An example demonstrates the relationship between checking policies and optimal inventory policies.

-

Optimal and adaptive testing for software reliability assessment

Optimal software testing is concerned with how to test software such that the underlying testing goal is achieved in an optimal manner. Our previous work shows that the optimal testing problem for software reliability growth can be treated as closed-loop or feedback control problem, where the software under test serves as a controlled object and the software testing strategy serves as the corresponding controller. More specifically, the software under test is modeled as controlled Markov chains (CMCs) and the control theory of Markov chains is used to synthesize the required optimal testing strategy. In this paper, we show that software reliability assessment can be treated as a feedback control problem and the CMC approach is also applicable to dealing with the optimal testing problem for software reliability assessment. In this problem, the code of the software under test is frozen and the software testing process is optimized in the sense that the variance of the software reliability estimator is minimized. An adaptive software testing strategy is proposed that uses the testing data collected on-line to estimate the required parameters and selects next test cases. Simulation results show that the proposed adaptive software testing strategy can really work in the sense that the resulting variance of the software reliability estimate is much smaller than that resulting from the random testing strategies. The work presented in this paper is a contribution to the new area of software cybernetics that explores the interplay between software and control.

-

Optimal ordering policies and sourcing strategies with supply disruption

Successful supply chain management has to find an effective sourcing strategy to cope with uncertainty in both supply and demand. Most of existing literature deals with the problems related to the uncertain demand, however, in this paper, we discuss a model in which a firm is in the face of demand uncertainty and supplier reliability uncertainty at the same time prior to a single selling season. The firm has two instants to order from two suppliers (one supplier is completely reliable and the other is unreliable), while the unreliable supplier’s reliability is uncertain at instant 1 and is completely observed at instant 2. To determine the cost-minimizing ordering strategies at both instants, the firm has to evaluate the trade-off between a more accurate forecast and a potentially higher unit cost at instant 2. We present the optimal supplementary order quantities with the realized reliability and give the optimal ordering policies and sourcing strategies at instant 1 under certain conditions. We find conditions under which the order quantity from the unreliable supplier at instant 1 is decreasing in the reorder costs at instant 2.

-

Allocation of empty containers between multi-ports

Owing to imbalances in international trade activities, shipping companies accumulate a large number of unnecessary empty containers in the import-dominant ports, whilst request a large number of empty containers in export-dominant ports. The logistics challenge to shipping companies is to better manage and control their containers, which consist of company-owned containers and leased containers. The multi-port empty container allocation problem is concerned with the allocation of empty containers from supply ports to demand ports. In this paper, optimal pairs of critical policies, (U, D) for one port, which are importing empty containers up to U when the number of empty containers in the port is less than U, or exporting empty containers down to D when the number of empty containers is larger than D, doing nothing otherwise, are adapted to multi-port case so that decision-makers can make decisions about allocating the right amounts of empty containers to the right ports at the right time. This allocation problem has been formulated and the heuristic methods are designed according to that the average cost using (u, d) policy at one port is convex in u and d. Furthermore, the examples show that, using the heuristic algorithm, the result in the inland line case is quite close to the lower bound, even the distance is not so close in the global line case.

-

Optimal ordering policy in a distribution system

In conventional inventory management, the retailers monitor their own inventory levels and place orders at the distributor when they think it is the appropriate time to reorder. The distributor receives these orders from the retailers, prepares the product for delivery. Similarly, the distributor will place an order at the manufacturer at the appropriate time. Generally, the order that the distributor places at the manufacturer is larger than that the retailer places at the distributor. In order to afford this large order, there should exist a long-term supply contract between the manufacturer and distributor that can guarantee a stationary supply to the distributor. This paper discusses this case, and derives the optimal stationary supply, that is, the optimal ordering policy of the distributor. Also computational results are presented.

-

Weighted singularly perturbed hybrid stochastic systems

In this paper weighted singularly perturbed hybrid stochastic systems are discussed. Under some reasonable assumptions, it is shown that there exists a uniformly δ-optimal policy when the perturbation is sufficiently small.

-

Analysis of monitoring and limiting of commercial cheating: a newsvendor model

Commercial cheating, that is, counterfeit products and lower quality products sold as genuine products, exists extensively in many countries of the world, especially in the developing countries. In this paper, we investigate the phenomena of commercial cheating, study the optimal cheating actions of inventory managers under a monitoring and limiting regime from the industrial administration office (IAO for short) and demonstrate the efficiency of monitoring and limiting such cheating activities. A newsvendor model has been considered for the inventory manager to order different quality products with different set-up costs. The model, a kind of extension of the general newsvendor problem, is viewed as a shocked inventory model. We analyse some properties of the optimal cheating policies from the point of view of an inventory manager, and investigate the effectiveness of both the punishment level and the checking rate.

-

Replenishment routing problems between a single supplier and multiple retailers with direct delivery

We consider the replenishment routing problems of one supplier who can replenish only one of multiple retailers per period, while different retailers need different periodical replenishment. For simple cases satisfying certain conditions, we obtain the simple routing by which the supplier can replenish each retailer periodically so that shortage will not occur. For complicated cases, using number theory, especially the Chinese remainder theorem, we present an algorithm to calculate a feasible routing so that the supplier can replenish the selected retailers on the selected periods without shortages.

-

Quantitative effects of software testing on reliability improvement in the presence of imperfect debugging

Software testing is essential for software reliability improvement and assurance. However, software testing is subject to imperfect debugging in the sense that new defects may be introduced into the software under test while detected defects are removed. The quantitative effects of software testing on software reliability improvement are obscure. In this paper we propose a Markov usage model to explore the quantitative relationships between software testing and software reliability in the presence of imperfect debugging. Several interesting quantities for software reliability assessment are derived and the corresponding upper and lower bounds are obtained.

-

Optimal control problems for a new product with word-of-mouth

In this paper, we consider a firm to maximize its profit by choosing a production capacity and determining the production and sales policies for a new product during the lifetime of the product. We extend Bass demand process into more general case including the negative effectiveness of word-of-mouth. Under some mild conditions, we show that the optimal sales policy is myopic, then we obtain the closed forms of the optimal production and sales policies in three cases. Furthermore, we can determine the optimal production capacity by solving several equations.

-

An inventory system with two suppliers and default risk

This paper considers the problem of joint replenishment and pricing for a single product with two suppliers and supply disruption. Our objective is to maximize the total profit by choosing an appropriate replenishment and pricing policy. We not only obtain that the form of the optimal policy has a (s,S,p,σ,Σ)-type, but also analyze how supply disruption affects the profit function and the optimal policy.

-

A note on coordination in decentralized assembly systems with uncertain component yields

Gurnani and Gerchak [H. Gurnani, Y. Gerchak, Coordination in decentralized assembly systems with uncertain component yields, European Journal of Operational Research 176 (2007) 1559–1576] study coordination of a decentralized assembly system in which the demand of the assembler is deterministic and the component yields are random. They present incentive alignment control mechanisms under which system coordination is achieved. In this note, we extend Gurnani and Gerchak’s model to the case of positive salvage value and n asymmetric suppliers, and show that the shortage penalty contract which can coordinate Gurnani and Gerchak’s model no longer coordinates the extended model. Furthermore, we present a new kind of contract, surplus subsidy contract, to coordinate the extended model and prove that the profit of the supply chain under coordination can be arbitrarily divided between the component suppliers and the assembler.

我的团队

-

- 刘克

- 研究员

-

- 张汉勤

- 研究员

-

- 吴凌云

- 研究员

-

- 王勇

- 研究员

我的相册

联系方式

-

联系地址:

中国北京海淀区中关村东路55号

-

联系电话:

(10) 82541905

-

电子邮件:

kliu@amss.ac.cn